You can also override the default/change the language in the app settings.

Plan ahead: Run scenarios on life events like getting married, having a baby or buying a home.

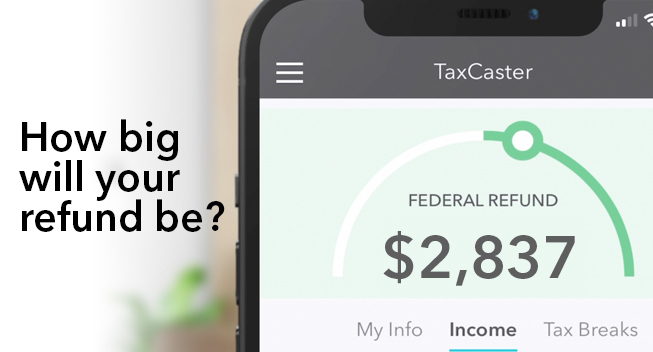

Know your taxes: Use an estimate from the federal income tax calculator to get a quick read on your taxes before you prepare your tax return.Up-to-date: Updated to 2022 tax laws for an accurate tax refund estimate.Send your TaxCaster data over to TurboTax to pre-select questions and start filing. Just enter some basic info and watch your refund add up.įree data transfer for new TurboTax customers.

This form is mailed out in late January for the prior tax year.This interactive, free tax refund calculator provides quick, accurate insights into how much you will get back or owe this year. However, distributions from an IRA are reported to you and the IRS on a Form 1099-R. Interest postings to IRAs are not reportable. Special note about Individual Retirement Accounts (IRAs) To issue you a Form 1099-INT, TD Bank reviews all of your account relationships (interest-earning accounts like checking, savings, money market and CD accounts) and sends one Form 1099-INT to cover all of your accounts in which you are the primary owner. If this applies to you, then you can expect to receive your tax information within the first two weeks of February. Typically, TD Bank mails 1099 tax forms to applicable customers in late January. If they are listed second on the account, they would be considered the secondary owner. You may co-own an account(s) with another person – spouse, partner, child, etc. If you are listed first on an account, you are considered the primary owner. Only the primary owner will receive a Form 1099-INT. For individuals, the Tax ID number is typically your Social Security number. Form 1099-INT is produced if the aggregated interest earned for a particular Tax ID number is $10 or more.

0 kommentar(er)

0 kommentar(er)